Reinsurance Loss Risk

- OmcEditor

- No Comments

How AI-Driven Clinical Reviews Transform Loss Risk Managementw AI-Driven Clinical Reviews Transform Loss Risk Management

In the dynamic world of reinsurance, accurately assessing and managing loss risk is crucial. Reinsurance carriers and stop-loss insurers must evaluate potential high-risk claims with precision to avoid catastrophic financial consequences. Traditionally, this process has relied heavily on manual clinical reviews, which, while thorough, can be time-consuming and prone to human error. Enter AI-driven clinical review — a transformative approach that leverages artificial intelligence to enhance efficiency, accuracy, and decision-making in the reinsurance landscape.

Understanding Reinsurance Loss Risk

Reinsurance loss risk involves the potential for significant claims that can impact an insurer’s financial stability. Reinsurance carriers mitigate this risk by spreading it across multiple parties, ensuring that no single entity bears the full brunt of a large claim. Accurate risk assessment is paramount to this process, as it helps reinsurance carriers set appropriate premiums, reserve funds, and maintain financial health.

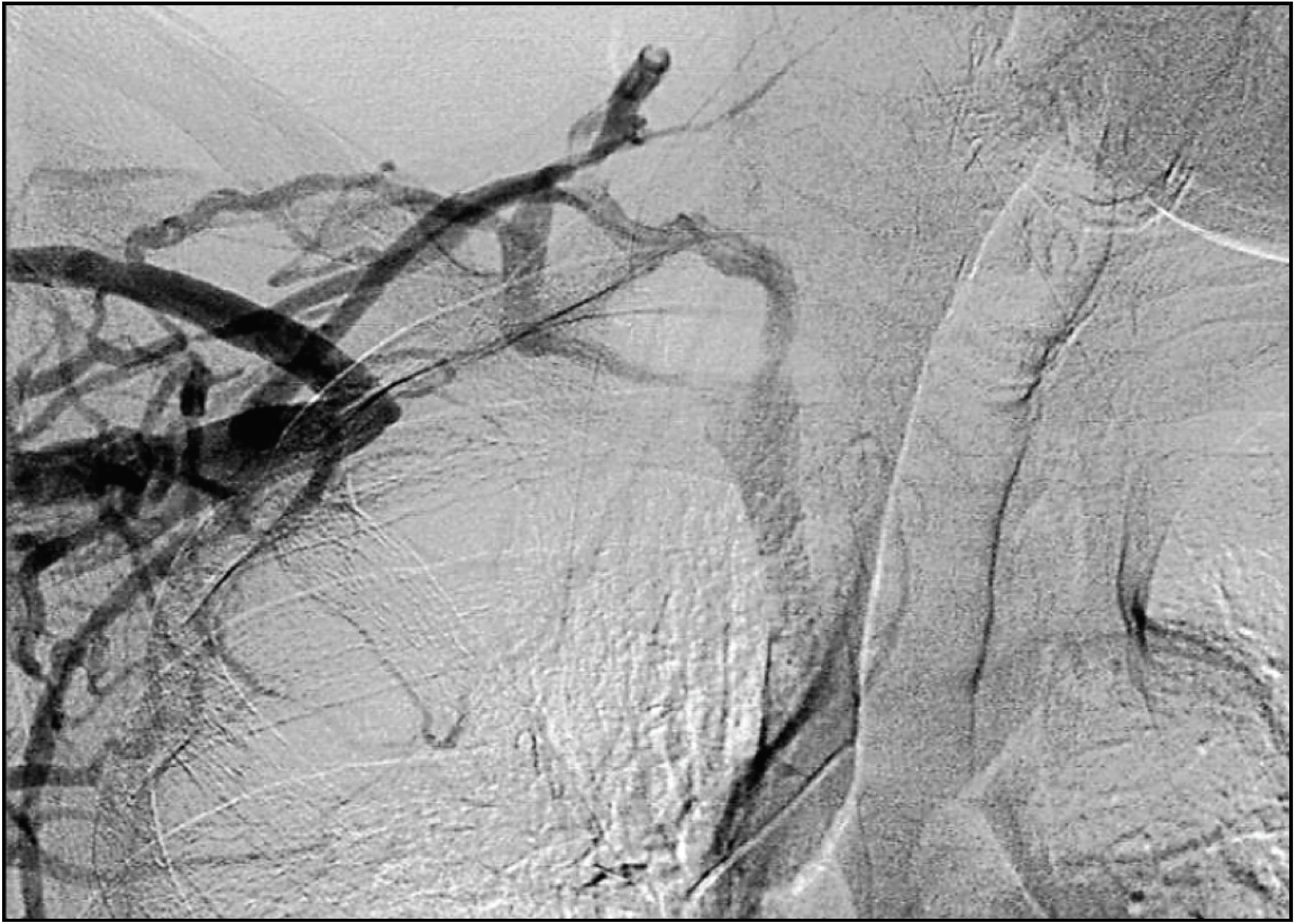

However, identifying and stratifying high-risk claimants is no small feat. This task requires analyzing vast amounts of structured and unstructured data—from medical records and treatment histories to billing information and diagnostic codes. Historically, this has been done manually by clinical experts, which, despite their expertise, is a labor-intensive process that can delay decision-making and increase costs.

The Benefits of AI-Driven Clinical Review

Artificial intelligence offers a game-changing solution to the challenges of manual clinical review. By automating data analysis and leveraging advanced algorithms, AI-driven platforms can swiftly and accurately assess reinsurance loss risk. Here are some key benefits:

1. Efficiency: AI platforms can process and analyze large datasets far quicker than human reviewers. For instance, OptMyCare (OMC) utilizes a highly efficient data platform that applies clinical expertise on a broad scale, cutting costs and saving valuable time. This allows reinsurance carriers to deliver accurate estimates within tight deadlines, enhancing their ability to respond swiftly to potential high-risk claims.

2. Accuracy: AI-driven clinical reviews significantly enhance predictive accuracy. OMC’s platform, for example, increases the predictive accuracy of diagnosis to up to 92 percent, compared to the average accuracy range of 60 to 70 percent in traditional manual reviews. This heightened accuracy not only improves the identification of high-risk claimants but also helps in uncovering undiagnosed conditions, providing invaluable insights for medical reviewers, case managers, and underwriters.

3. Clinically Driven Insights: AI platforms like OMC’s are developed by certified medical experts and key opinion leaders with firsthand experience in fields most impacted by high-cost claims. This clinical expertise ensures that the analytics and recommendations are grounded in practical, real-world medical knowledge, leading to more reliable and actionable insights.

Case Study: AI in Action

Consider a scenario where a reinsurance carrier must evaluate a pool of claims to identify high-risk individuals with chronic conditions such as diabetes or heart disease. Manually reviewing each claim would require significant time and resources. However, an AI-driven platform can quickly sift through the data, identifying patterns and anomalies that indicate high-risk cases. For instance, OMC’s platform can efficiently organize both structured and unstructured data, pinpointing potential high-cost claimants and recommending targeted interventions to mitigate risk.

In one case, a reinsurance carrier using OMC’s platform was able to identify a subset of claimants who were at high risk for severe complications due to undiagnosed conditions. By flagging these individuals early, the carrier could implement proactive treatment strategies, ultimately reducing the likelihood of catastrophic claims and ensuring better health outcomes for the claimants.

Conclusion: OptMyCare’s Role in Transforming Reinsurance

OptMyCare (OMC) stands at the forefront of this AI-driven transformation in reinsurance. By optimizing the identification, risk stratification, mitigation, and treatment strategy recommendations for early-onset through advanced chronic medical conditions, OMC revolutionizes how stop-loss and reinsurance carriers manage high-risk cases.

OMC streamlines and organizes both structured and unstructured data, efficiently identifying potential high-risk and high-cost claimants. This not only enhances predictive accuracy but also supports risk managers in making informed decisions swiftly. OMC’s platform, developed by certified medical experts, empowers risk reviewers by providing clinically driven insights, facilitating collaboration with on-site professionals, and resolving complex cases in a matter of hours.

In an industry where timely and accurate risk assessment is crucial, AI-driven platforms like OMC’s represent a significant leap forward, helping reinsurance carriers avoid catastrophic claims and make the right business decisions with confidence.

For more information on how OptMyCare can transform your reinsurance loss risk management, visit OptMyCare’s website.