OMC Solutions for Stop-Loss & Reinsurance

Optimizing the Identification, Stratification and Treatment of All Chronic Conditions~

OptMyCare streamlines data and efficiently identifies high-risk, high-cost claimants, revolutionizing how stop-loss and reinsurance carriers deliver accurate estimates within tight deadlines.

Supporting risk- bearing entities in identifying, stratifying, and managing high-risk, high-cost cases.

- Efficient: OMC’s highly efficient data platform takes the clinical expertise associated with individualized case reviews and applies it on a large-scale, cutting costs and saving valuable time.

- Accurate: OMC’s platform increases the accuracy of diagnosis and even helps identify claimants that have yet to be diagnosed, giving underwriters information they would not have had in the past.

- Clinically Driven: OMC’s analytics were developed by a team of certified medical experts with firsthand experience in fields most-impacted by high-cost claims.

- Optmycare facilitates your in – place team of risk review: By working closely with on-site professionals such as pharmacists, social workers, and billing specialists, OMC is positioned to assist your team of risk reviewers in resolving the most complex cases in a matter of hours. OMC will empower your underwriting and claims review processes, helping your team make the right business decisions.

25%

Penetration in Reinsurance market.

15%

Penetration in First Dollar insurance market.

40m

Americans will have some level of stop loss coverage in addition to their primary insurance.

30%

Clinical reviews that would require stop loss underwriting.

Imagine increased predictive accuracy among highest-risk populations

Risk Stratification/Cost Prediction

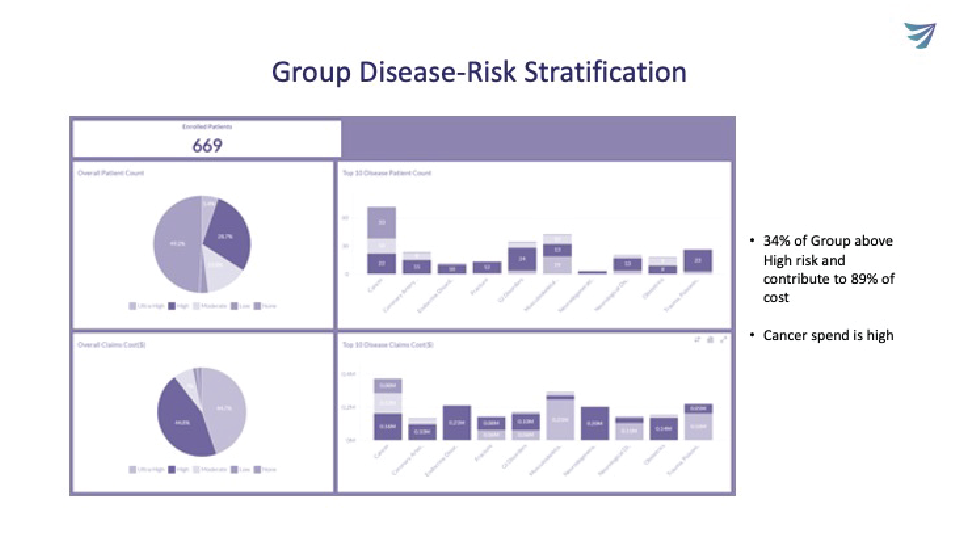

Self-Insured Applications include our ability to accurately analyze and stratify risk levels into four distinct categories: ultra-high, high, moderate, and low risk potentials.

Leveraging ML for Accuracy

The OMC platform is unique in that the analytics are underpinned by years of proven clinic experience and are supplemented/refined through machine learning (ML) processes.

Client Benefits

Clients get a secure server with their members uploaded with risk and cost prediction information through our C-suite service option. Cost outlier members within a group would be manually reviewed, and lasers would be posted.

Risk Mitigation / Cost Control

The OMC platform allows underwriters to accurately mitigate risk through targeted application of rate increases, lasers, and other underwriting and pricing tools to groups with identified ultra-high and high-risk individuals.

5 percent of the population accounts for 45 percent of total healthcare costs.

Optmycare Kpi's

– Accuracy rates average 78-92% on predicting cost for an entire cohort at a disease level across multiple risk levels.

– High accuracy in the correlations between disease risk and claims cost.

– 48- to 72-hour turnaround for cost and disease risk analysis.

We harmonize and leverage historical data for renewals and new claims and provide the clients access to that on a subscription basis. Our cloud-based platform allows underwriters and reviewers to access our results remotely without any delay in the underwriting process.